Compared to before, when not so many people were aware of digital currencies, as time passed, they have now appeared on the radar. The use of cryptocurrencies in various commercial areas has grown popular.

It is becoming more widespread, especially in legal and consulting services. The main topic of this article is the reasons that legal firms ought to consider integrating cryptocurrency payments into their financial operations.

The main goal here is to review the advantages and important factors related to using digital currencies like Bitcoin transactions. The legal and consulting industries can increase efficiency, reduce transaction fees, and attract new clients by appealing to those who use contemporary payment methods by taking cryptocurrency payments. We will also discuss how cryptocurrencies can make cross-border transactions easier without requiring conventional financial systems.

We will evaluate how digital assets, blockchain technology, and private keys are essential in reinventing transactional processes as we examine the different facets of crypto application in these professional services.

We will also talk about how accepting cryptocurrency will affect controlling the risks of financial crimes like money laundering, making sure anti-money laundering (AML) regulations are followed, and responding to new threats inside the legal system.

Key Takeaways

- Law firms can ethically integrate cryptocurrencies by following state-specific regulations, guaranteeing compliance, and appealing to customers who prefer modern payment methods.

- Blockchain technology lowers the risk of fraud by improving the security and transparency of transactions in the legal and consultancy industries.

- Accepting cryptocurrencies enables businesses to grow their clientele and carry out cross-border transactions more successfully by reducing transaction costs and expanding into new areas.

- Legal and consulting services must continuously educate themselves and adapt to new technological advancements to properly manage risks and capitalise on cryptocurrencies’ advantages.

Ethical Considerations for Accepting Crypto Payments

A full grasp of the advantages and possible drawbacks of digital currencies is necessary to integrate them into legal procedures. Law firms are faced with a complex array of ethical problems as they take more and more cryptocurrency payments, especially with regard to financial transparency and compliance.

Nebraska has been leading the way in the US in developing regulations for legal practices that decide to accept cryptocurrency as payment. To reduce the risks related to price fluctuation, Nebraska’s recommendations strongly emphasise changing cryptocurrencies, such as Bitcoin, into US dollars as soon as they are received. This instant conversion complies with professional indemnity insurance regulations while preserving the integrity of financial management.

These rules also require law firms to handle and protect cryptocurrency payments with the same diligence level as traditional funds. This involves ensuring that every transaction is safe, traceable, and without dangers associated with financial crimes like money laundering. Law firms should also utilise crypto wallets that adhere to strict regulatory standards to stop false chargebacks and other types of financial fraud.

Legal firms can ethically incorporate cryptocurrencies into their payment systems by following state-specific ethical judgements and requirements. This integration aligns with broader adoption trends in the digital asset industry and gives a competitive edge by appealing to new clients who prefer contemporary payment methods.

Additionally, the decentralised nature of blockchain technology, which powers these online crypto transactions, offers improved security and ease to customers, which enhances business operations and improves customer satisfaction for the company.

Technology and Security

Blockchain technology improves the security and transparency of financial transactions. The foundation of cryptocurrencies is this technology, which makes safe, decentralised transactions possible without intermediaries like banks. Because blockchain technology is immutable, once a transaction is recorded, it cannot be undone, significantly lowering the possibility of fraud and improving transaction integrity.

Adopting blockchain technology for digital currency payments when discussing legal and consultancy services guarantees that transactions are transparent and verifiable. Transparency like this aids in risk management and regulatory compliance, especially when fighting financial crimes like money laundering.

Law firms and consulting services can take specific security precautions when managing cryptocurrency transactions, including using advanced digital currency wallets with solid security features like multi-signature wallets and 2FA. These wallets help shield money from potential security lapses and unauthorised access by storing the cryptographic keys required to access cryptocurrencies safely.

Peer-to-peer technology also makes it easier for parties to deal directly with one another, lowering transaction costs and removing the requirement for a traditional bank account. This gives customers more convenience by reducing the payment cost and expediting the transaction procedure.

Legal services must retain a thorough understanding of the technology involved and do due diligence before integrating crypto payments. This entails keeping informed of any new laws relating to the cryptocurrency sector and collaborating with trustworthy wallet providers to guarantee the safe management of client monies and company assets. Through this approach, legal companies and consulting firms can effectively leverage the advantages of digital currencies while maintaining compliance and gaining a competitive edge in the swiftly changing legal industry.

As of today, more than 15,000 companies and businesses accept cryptocurrency payments.

Why Can It Be Beneficial For Legal Firms To Accept Crypto Payments?

Legal and consulting services can significantly benefit from accepting cryptocurrency, including reduced transaction costs and increased operational effectiveness. Cryptocurrency payments usually have low fees compared to conventional payment methods that require banks and other financial intermediaries. This cost reduction can be very beneficial for businesses doing overseas transactions, where fees and currency conversion rates could ordinarily be significant.

A growing number of consulting businesses and law firms have already begun to take crypto, mostly accepting Bitcoin payments, realising the ease and flexibility it offers their clients. As we mentioned, cryptocurrencies offer accessibility and worldwide reach.

They allow consulting businesses and legal firms to accept payments from all over the world without requiring them to have a bank account or to adhere to different national currency restrictions. Due to its worldwide accessibility, businesses can grow their clientele into foreign markets without dealing with the administrative and financial hassles of conducting business internationally.

Furthermore, using digital wallets and cryptocurrencies enables faster transaction times compared to conventional banking procedures. This speed and the capacity to transact around the clock boost client convenience and can help enterprises with their cash flow. Quick fund receipt and access are essential for firms.

Service providers can present themselves as progressive leaders in their respective sectors and satisfy the demands of a technologically advanced clientele by incorporating crypto payments. Using new payment methods like Bitcoin and other digital coins might provide businesses a competitive edge in a market that is becoming increasingly digital.

Challenges and Solutions

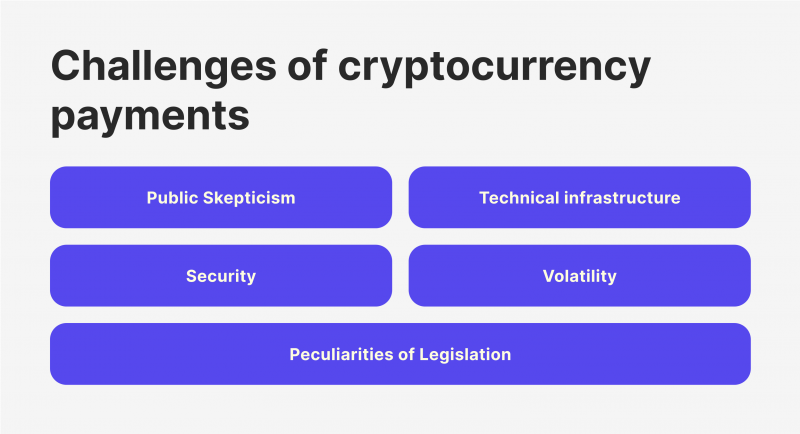

Legal and consulting services face several obstacles to using cryptocurrencies, chief among them being technical intricacy and regulatory ambiguity.

Regulatory Uncertainty: The absence of uniform laws governing the usage of cryptocurrencies presents severe difficulties for the legal industry. Due to this ambiguity, law firms and consulting firms may find it challenging to guarantee that all current financial rules are followed, particularly those about AML and the handling of client cash.

Technical Difficulty: Establishing and protecting digital wallets, among other technical facets of executing and overseeing crypto payments, may be pretty difficult. Understanding blockchain technology, keeping track of private keys, and staying safe online are all necessary for maintaining these networks.

Several Solutions

Every problem has its solution. Below, we will discuss several ways to solve problems.

- Keeping Up: Businesses must keep up with any new legislation linked to the cryptocurrency sector to minimise these difficulties. Firms can stay up and running by holding regular training sessions and receiving legal updates.

- Employing Trusted Technology Vendors: Working with trustworthy wallet and cryptocurrency payment providers can simplify the technical aspects of cryptocurrency transactions. These suppliers provide systems that are easy to use and manage the complicated elements of blockchain technology while guaranteeing the safety of digital assets.

- Putting Strong Security Measures in Place: Businesses should take strong safety precautions for their cryptocurrency transactions to guard against financial crime and fraudulent chargebacks. This covers the keeping of digital assets in cold storage and the use of multi-factor authentication.

- Creating Explicit Policies: Legal firms and consulting services should develop explicit policies when accepting cryptocurrency payments. These policies should contain instructions on instantly converting cryptocurrency to fiat money to reduce the risk brought on by price fluctuation.

- Financial and Legal Advice: Businesses can consult with specialists in financial management and cryptocurrency legislation to handle regulatory requirements and manage the possible risks associated with crypto payments.

Law firms and consulting services can profit from taking these payments while managing the dangers by tackling these issues with well-thought-out plans and firm answers.

The Future of Crypto in the Consulting and Legal Sector

The legal and consulting industries are expected to increase significantly in cryptocurrency use in the upcoming years. Blockchain technology and digital assets have the potential to completely transform these sectors by improving transaction security and streamlining financial operations as they develop.

Increased Adoption

As digital currency standards develop and become established in corporate operations, cryptocurrency payments will be more accepted. The advantages of crypto assets, such as lower transaction fees and removing intermediaries, which can drastically cut the costs and complexity of cross-border transactions, are driving this acceptance.

Technological Adaptation

Law firms and consulting firms should anticipate using cryptocurrency wallets and crypto exchanges more frequently as part of their financial operations. Because of blockchain technology’s transparent nature and the increased control over financial transactions it offers, using these tools can help businesses manage risk more successfully.

Ongoing Education

For professionals in the legal and consulting fields, continuing their education in cryptocurrencies and blockchain technology will be essential to adapt to these changes. To fully exploit the promise of digital currencies, learning and adapting as these technologies advance continuously will be necessary.

Managing Risk

Given the rise in cryptocurrency transactions, law firms must concentrate on risk management techniques to guard against volatility and guarantee adherence to financial regulations. Creating strong standards for managing cryptocurrency payments and teaching employees the newest cryptographic security techniques will be crucial.

The early and effective adoption of cryptocurrencies will significantly benefit these industries by increasing the efficiency and security of financial transactions.

Final Thoughts

Integrating cryptocurrency offers strategic advantages by lowering expenses, increasing market reach, and improving transaction efficiency. Law firms and consulting services that adjust early to this virtual currency environment may gain a competitive edge as the crypto business expands.

Businesses are urged to think about the long-term benefits of taking cryptocurrency payments. They can improve operational security and customer convenience by retaining control over their financial transactions through virtual currency usage and private critical ownership. Cryptocurrencies are a proactive step that keeps pace with technology advancements and customer expectations in a digital age rather than just following a trend.

Law societies and other legal industry enterprises’ use of cryptocurrencies should be considered a calculated investment in their future, placing them at the forefront of customer service and innovation.

FAQs

Are lawyers allowed to accept crypto?

Each lawyer is ultimately responsible for whether or not to accept cryptocurrencies as payment from clients. While some may choose to take these payments, others may not.

Is taking cryptocurrency as payment legal?

The IRS considers cryptocurrencies to be “property” for tax purposes. According to this classification, any acceptance of cryptocurrency must be recorded as gross revenue at the moment of receipt at its fair market value. Capital gains tax is applied to all crypto-related transactions, including purchases, sales, and uses.

How does crypto affect law firms?

Blockchain technology can help lawyers execute transactional tasks more efficiently by allowing them to sign and safely preserve legal papers digitally. Smart contracts and automated contract management tools can significantly reduce the time needed to prepare, modify, and oversee ordinary legal documentation.